Porter’s Five Forces

Porter’s Five Forces is a simple but powerful tool for understanding the competitiveness of your business environment, and for identifying your strategy’s potential profitability. This is useful, because, when you understand the forces in your environment or industry that can affect your profitability, you’ll be able to adjust your strategy accordingly. For example, you could take fair advantage of a strong position or improve a weak one, and avoid taking wrong steps in the future.

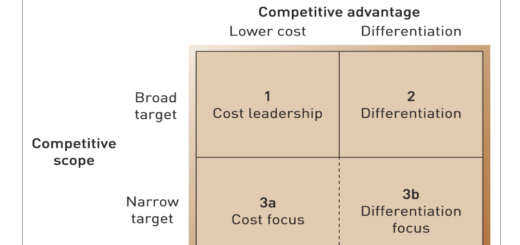

Michael Porter’s Five Forces is a framework used to analyze the competitive forces that affect an industry or market. The five forces are:

- The threat of new entrants: the ease with which new competitors can enter the market. This is influenced by factors such as barriers to entry, economies of scale, and brand recognition.

- Bargaining power of suppliers: the ability of suppliers to influence the price or quality of goods or services. This is influenced by factors such as the number and size of suppliers, the availability of substitutes, and the importance of the supplier’s product to the buyer.

- Bargaining power of buyers: the ability of buyers to influence the price or quality of goods or services. This is influenced by factors such as the number and size of buyers, the availability of substitutes, and the importance of the product or service to the buyer.

- The threat of substitutes: the availability of alternatives to the product or service. This is influenced by factors such as the number and quality of substitutes, and the cost of switching to a substitute.

- Rivalry among existing competitors: the intensity of competition between existing players in the market. This is influenced by factors such as the number and size of competitors, the level of product differentiation, and the degree of market concentration.

The objective of the Five Forces framework is to help companies understand the competitive forces that affect their industry or market, and develop strategies to gain a competitive advantage. By analyzing the five forces, companies can identify the key drivers of competition and make informed decisions about pricing, marketing, product development, and other aspects of their business strategy.

Strengths & Weakness of Porter’s 5 Forces Model

Strengths:

- Comprehensive analysis: The model provides a comprehensive framework for analyzing an industry’s competitive environment, taking into account various internal and external factors that can affect its profitability.

- Focus on key factors: The model focuses on the most important factors that influence an industry’s profitability, such as the bargaining power of suppliers and buyers, the threat of new entrants, the threat of substitute products, and the intensity of rivalry among existing competitors.

- Provides insights: The model provides insights into the competitive dynamics of an industry, helping companies to identify areas of strength and weakness and develop effective strategies to compete more effectively.

- Easy to use: The model is simple and easy to use, making it accessible to businesses of all sizes and industries.

Weaknesses:

- Limitations of the model: The model has some limitations, including the fact that it is static and does not account for changes in the industry over time. For example, it does not take into account technological changes, shifts in consumer preferences, or changes in government regulations.

- Difficulty in quantifying factors: It can be difficult to quantify some of the factors analyzed by the model, such as the bargaining power of suppliers or the threat of substitute products, which can limit the usefulness of the analysis.

- Narrow focus: The model’s focus on competitive forces may limit the broader strategic thinking of companies, as it only considers the external environment and not the internal capabilities and resources of the organization.

- Potential for oversimplification: The model’s simplicity can sometimes oversimplify complex business dynamics, leading to incomplete or inaccurate analyses.

Overall, Porter’s Five Forces model is a useful tool for analyzing an industry’s competitive structure and its potential profitability, but it should be used in conjunction with other analytical frameworks and strategic thinking to develop a more comprehensive and nuanced understanding of the industry and the competitive landscape.

Attractiveness of Business

The attractiveness of a business according to Porter’s Five Forces framework depends on the strength and balance of the five competitive forces within that industry or market. A more attractive business is one where the competitive forces are weaker, giving companies within that industry more power to influence pricing, quality, and other aspects of their business strategy.

Some factors that may make a business more attractive according to Porter’s Five Forces include:

- High barriers to entry: If it’s difficult for new competitors to enter the market, existing companies may have a stronger market position and more pricing power.

- Weak supplier power: If there are many suppliers in the market or if suppliers have low bargaining power, companies may have more control over the quality and price of their inputs.

- Weak buyer power: If there are few buyers in the market or if buyers have low bargaining power, companies may have more control over the price and distribution of their products.

- Few substitutes: If there are few close substitutes for a company’s products or services, the company may have more pricing power and a stronger market position.

- Low rivalry: If there are few competitors in the market or if competition is weak, companies may have more pricing power and a stronger market position.

Unattractivenss of Business:

According to Porter’s Five Forces framework, the unattractiveness of a business is determined by the strength and balance of the five competitive forces within that industry or market. A less attractive business is one where the competitive forces are stronger, limiting the power and profitability of companies within that industry.

Some factors that may make a business less attractive according to Porter’s Five Forces include:

- Low barriers to entry: If it’s easy for new competitors to enter the market, existing companies may face increased competition, lower pricing power, and lower profitability.

- Strong supplier power: If there are few suppliers in the market or if suppliers have strong bargaining power, companies may face higher input costs and lower profitability.

- Strong buyer power: If there are many buyers in the market or if buyers have strong bargaining power, companies may face pricing pressure and reduced profitability.

- Many substitutes: If there are many close substitutes for a company’s products or services, the company may face increased competition, pricing pressure, and reduced profitability.

- High rivalry: If there are many competitors in the market or if competition is intense, companies may face pricing pressure and reduced profitability.

It’s important to note that the attractiveness of a business according to Porter’s Five Forces framework can vary depending on the specific industry and market conditions, and companies need to take a range of other factors into account when making strategic decisions.