Evaluating Business Strategy: Suitability, Feasibility & Acceptability

SAFe criteria are used to evaluate the suitability, acceptability, and feasibility of a strategy. These criteria are essential in determining whether a proposed strategy is likely to succeed or not. Here are the SAFe criteria for strategy:

| Suitability | Does a Proposed strategy address the key opportunities and constraints an organization faces? |

| Acceptability | Does the strategy meet the expectation of stakeholders? Is the level of Risk acceptable? Is the Likely Return acceptable? Will stakeholders accept the strategy? |

| Feasibility | Would a Purposed strategy work in Practice? Can the Strategy be financed? Do people and their skills exist or can they be obtained? Can the required resources be obtained or integrated? |

Suitability:

Suitability refers to whether the strategy is a good fit for the organization, its vision, mission, and objectives. The strategy should align with the company’s strengths, weaknesses, opportunities, and threats (SWOT analysis). It should also take into account the market trends, customer needs, and competitive landscape. A strategy that is not suitable for the organization may not deliver the desired results, even if it’s feasible and acceptable.

Suitability is concerned with assessing which proposed strategies address the key opportunities & constraints an organisation faces, through an understanding of the strategic position of an organisation.

It is concerned with the overall rationale of the strategy:

- Does it exploit the opportunities in the environment and avoid threats?

- Does it capitalize on the organization’s strengths and strategic capabilities and avoid or remedy the weaknesses?

Acceptability:

Acceptability refers to whether the strategy is acceptable to the stakeholders of the organization, including employees, customers, shareholders, and other external stakeholders. The strategy should be consistent with the values, culture, and ethical standards of the organization. It should also be acceptable to external stakeholders, such as regulators, the government, and the wider society. A strategy that is not acceptable may face resistance from the stakeholders, which may impede its implementation and success.

Acceptability is concerned with whether the expected performance outcomes of a proposed strategy meet the expectations of stakeholders.

There are three key aspects of acceptability – the ‘3 R’s’:

- Risk concerns the extent to which the outcomes of a strategy can be predicted

- Returns are the financial benefits that stakeholders are expected to receive from a strategy

- Risk and Return can be assessed using the:

- Financial forecasting

- Cost-benefit analysis

- Scenario and sensitivity analysis

- Risk and Return can be assessed using the:

- Reactions of stakeholders can be used to:

- understand the political context of strategies

- gauge the likely viewpoints of stakeholders on specific strategies

If key stakeholders find a strategy to be unacceptable then it is likely to fail

Feasibility:

Feasibility refers to whether the strategy can be implemented given the available resources and capabilities of the organization. This includes financial resources, human resources, technology, infrastructure, and other resources. A strategy that is not feasible may not be achievable, regardless of its suitability or acceptability.

Two key questions:

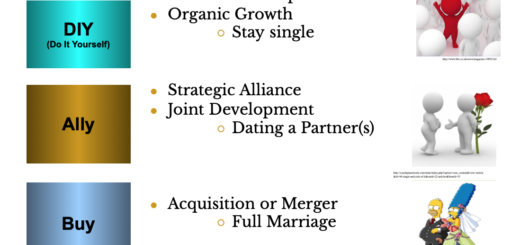

- Do the resources and competencies currently exist to implement the strategy effectively?

- If not, can they be obtained?

Integrating resources: The success of a strategy depends on the management of many resource areas, for example:

- people,

- finance,

- physical resources,

- information,

- technology and

- resources provided by suppliers and partners.

- It is essential to integrate resources – inside the organization and in the wider value network.