Methods of Strategy Delivery

A. Do it Yourself:

“DIY (Do-It-Yourself) Strategy Delivery” approach involves a company developing and implementing its strategy on its own, using its own resources, people, and technology. This method is suitable for companies with strong internal capabilities, sufficient resources, and expertise in the areas where they want to grow. The advantage of the DIY method is that it allows companies to maintain control over the entire strategy process and make changes as needed. However, it can also be time-consuming and costly, and may not be feasible for companies that lack the necessary resources or expertise.

Organic development is where a strategy is pursued by building on and developing an organization’s own capabilities. This is essentially ‘do it yourself’’ method.

Corporate entrepreneurship refers to radical change in the organization’s business, driven principally by the organization’s own capabilities. Ex; Amazon’s development of Kindle using its own in-house development.

- Internal Development

- Organic Growth

- Stay single

Advantages of “Do it Yourself”

- Knowledge and learning can be enhanced.

- Spreading investment over time – easier to finance.

- No availability constraints – no need to search for suitable partners or acquisition targets.

- Strategic independence – less need to make compromises or accept strategic constraints.

B. Ally

“Ally Strategy Delivery” approach involves a company partnering with other organizations to implement its strategy. This can include forming alliances, joint ventures, or partnerships with other companies, suppliers, or even customers. The advantage of the Ally method is that it allows companies to leverage the strengths and resources of other organizations to achieve their goals. It can also help to spread the risk of the strategy across multiple parties. However, it can also be challenging to coordinate and manage these partnerships effectively.

A strategic alliance is where two or more organizations share resources and activities to pursue a strategy.

It’s about a Collaborative advantage by managing alliances better than competitors.

Different types of Alliances: There are four types of alliances:

- Scale alliances: Alliances in which all partners contribute similar resources and assets. In this type of alliance, partners contribute similar resources and assets, such as capital, technology, or distribution channels, to achieve economies of scale. Scale alliances can help partners reduce costs and increase efficiency, as they can share the burden of fixed costs such as research and development or production facilities.

- An example of a scale alliance is the partnership between Renault-Nissan-Mitsubishi, a global automotive alliance that includes three of the world’s largest automakers. The companies have formed a strategic alliance to share resources and develop economies of scale by pooling their research and development, production, and supply chain capabilities.

- Overall, the scale alliance between Renault-Nissan-Mitsubishi is an example of how companies can form strategic partnerships to achieve economies of scale, reduce costs, and remain competitive in a rapidly changing market.

- Access alliances: In an access alliance, partners share access to resources or capabilities that they do not have or cannot develop on their own. For example, a company may form an alliance with a supplier to secure access to critical components or raw materials, or with a distributor to access new markets.

- An example of an access alliance is the partnership between Starbucks and PepsiCo. Starbucks, a leading coffee retailer, has formed a strategic alliance with PepsiCo, a global food and beverage company, to expand its distribution and access new markets.

- The Starbucks-PepsiCo alliance is an example of how companies can form strategic partnerships to gain access to new markets and customers, while also sharing knowledge and expertise to create value and drive growth.

- Complementary alliances: Complementary alliances involve partners with different strengths and capabilities coming together to create a mutually beneficial arrangement. For example, a technology company may form an alliance with a marketing company to leverage their respective strengths in product development and marketing to create a new product or service.

- An example of complementary alliances is the partnership between Apple and Nike. Apple, a technology company, has formed a strategic alliance with Nike, a global athletic footwear and apparel company, to combine their strengths in technology and fitness.

- The Apple-Nike alliance is an example of how companies can form strategic partnerships to combine their complementary strengths and create new products and services that offer unique value to customers. By sharing their knowledge and expertise, Apple and Nike have been able to create a successful partnership that benefits both companies and their customers.

- Collusive alliances: This type of alliance is less common and can be controversial. It involves partners collaborating to restrict competition, such as by setting prices or dividing markets. Collusive alliances are subject to antitrust laws and regulations in many countries.

- It is important to note that collusive alliances are illegal and violate antitrust laws, which prohibit companies from working together to limit competition or control prices. As such, there are no legitimate examples of collusive alliances to provide.

- These types of alliances are more negatively-perceived, especially by regulators. DeBeers Diamonds and OPEC are typical examples of these types of alliances.

Motives for Alliances:

- Scale alliances: lower costs, more bargaining power and sharing risks.

- Access alliances: partners provide needed capabilities (e.g. distribution outlets or licenses to brands)

- Complementary alliances: bringing together complementary strengths to offset the other partner’s weaknesses.

- Collusive alliances: to increase market power. Usually kept secret to evade competition regulations.

Types of strategic alliance

There are two main kinds of ownership in strategic alliances:

- Equity alliances involve the creation of a new entity that is owned separately by the partners involved.

- Non-equity alliances are typically more looser, without the commitment implied by ownership.

C. Buy

“Buy Strategy Delivery” approach involves a company acquiring other companies or assets to implement its strategy. This can include mergers and acquisitions, purchasing technologies, or other resources that the company needs to achieve its goals. The advantage of the Buy method is that it can provide immediate access to new capabilities, technologies, or markets. However, it can also be costly, time-consuming, and risky, and may require significant integration efforts to ensure that the new assets or companies fit well with the existing business.

- A merger is the combination of two previously separate organisations, typically as more or less equal partners.

- An acquisition involves one firm taking over the ownership (‘equity’) of another, hence the alternative term ‘takeover’.

Strategic motives for Merger &Acquisition

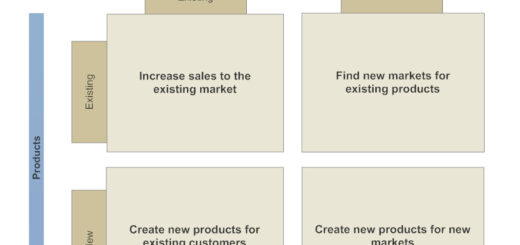

Strategic motives can be categorised in three ways:

- Extension – of scope in terms of geography, products or markets

- Consolidation – increasing scale, efficiency and market power

- Capabilities – enhancing technological know-how (or other competences)

Financial Motives for Merger & Acquisition

There are three main financial motives:

- Financial efficiency – a company with a strong balance sheet (cash rich) may acquire/merge with a company with a weak balance sheet (high debt).

- Tax efficiency – reducing the combined tax burden.

- Asset stripping or unbundling – selling off bits of the acquired company to maximise asset values.

Manegerial Motives for Merger & Acquisition

M&A may serve managerial self-interest for two reasons:

- Personal ambition:

- financial incentives tied to short-term growth or share-price targets;

- boosting personal reputations;

- giving friends and colleagues greater responsibility or better jobs.

- Bandwagon effects:

- managers may be branded as conservative if they don’t follow a M&A trend;

- shareholder pressure to merge or acquire;

- the company may itself become a takeover target.

Target Choice in Merger & Acquisitions

Two main criteria apply:

- Strategic fit: does the target firm strengthen or complement the acquiring firm’s strategy? (It is easy to overestimate this potential synergy).

- Organisational fit: is there a match between the management practices, cultural practices and staff characteristics of the target and the acquiring firm?

Determinant of Merger Success:

- Compatibility at the top

- the key people need to have a rapport (bond), trust and commitment to each other

- A shared vision of the industry’s future

- A clear benefit case

- it is vital that a strong benefits case is put forward to avoid the merger coming under attack from city analysts

- Sticking to a fair valuation

- its often difficult for owners or senior management to accept the valuation of their own company.

- Handling symbolic issues: E.g. location of HQ, corporate branding etc.

- A new Board: Phillippe Haspeslagh, the author of Mastering Strategy emphasizes that these factors to reduce the odds of a merger failing but they do not necessarily determine success.

Comparing acquisitions, alliances & organic development

Acquisitions, alliances, and organic development are three different strategies that companies can use to grow and expand their businesses. Here’s a brief comparison of the three:

- Acquisitions: An acquisition is a strategy where one company acquires another company through a purchase of all or a majority of the target company’s shares. Acquisitions are a fast way to expand a company’s operations and gain access to new markets, technologies, and customers. However, they can be expensive and risky, as the acquiring company must integrate the acquired company’s operations, culture, and employees into its own.

- Alliances: Alliances are partnerships between two or more companies that work together to achieve a common goal. Alliances can take different forms, such as joint ventures, licensing agreements, or distribution partnerships. Alliances can be beneficial for companies that want to expand their reach, access new markets, or share resources and expertise. However, they can also be challenging to manage, as partners may have different goals, cultures, or ways of doing business.

- Organic Development: Organic development is a strategy where a company grows its business through internal development and expansion. This can include investing in research and development, marketing, and production to improve existing products or create new ones. Organic development can be a slower and more gradual process than acquisitions or alliances, but it can be less expensive and more controllable. However, it may not provide the same level of access to new markets, technologies, or customers as acquisitions or alliances.

Overall, the choice of strategy depends on a company’s goals, resources, and risk tolerance. Companies that want to grow quickly and have the financial resources to do so may choose acquisitions, while those that want to leverage their existing strengths and relationships may choose alliances. Companies that want to grow steadily and maintain control may choose organic development. Ultimately, the success of any growth strategy depends on a company’s ability to execute it effectively and adapt to changing market conditions.

My spouse and i felt now peaceful Raymond could conclude his investigation by way of the precious recommendations he was given from your web page. It’s not at all simplistic just to possibly be freely giving methods which often men and women might have been trying to sell. So we take into account we have you to be grateful to for this. The most important illustrations you have made, the simple website menu, the relationships your site help to promote – it is mostly fabulous, and it’s really aiding our son and our family do think that article is fun, and that is very indispensable. Thank you for all!