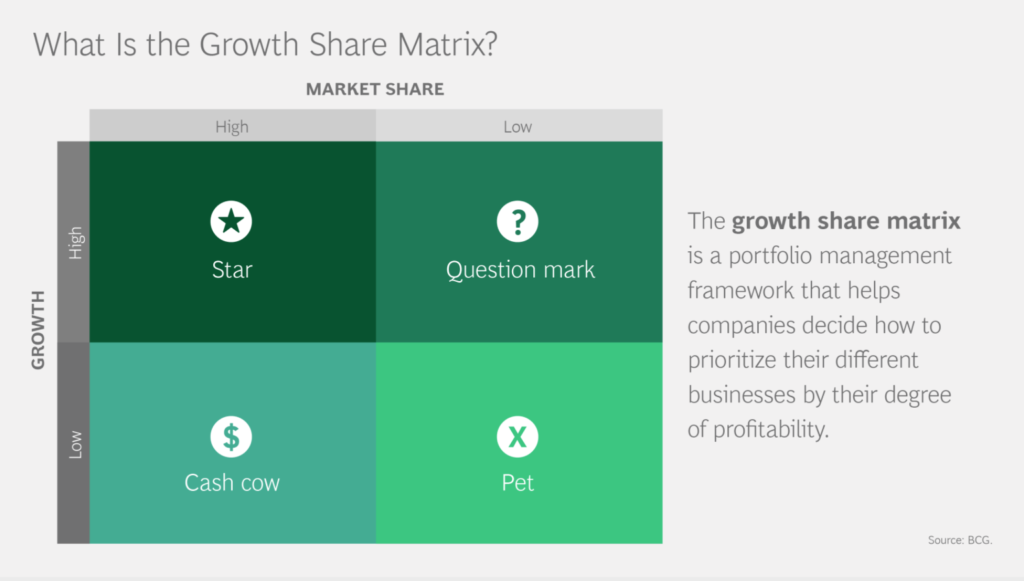

Growth Share (BCG) Matrix

The BCG Matrix, also known as the Boston Consulting Group Matrix, is a strategic planning tool that helps businesses analyze their product portfolio in terms of market share and growth potential. The matrix was developed by the Boston Consulting Group in the 1970s and is widely used by businesses to evaluate their product lines and make strategic decisions about resource allocation.

The BCG Matrix categorizes a company’s products into four quadrants based on two dimensions: market share and market growth rate. The two dimensions are defined as follows:

- Market share: the percentage of the total market for a product or service that is held by a particular company or brand.

- Market growth rate: the rate at which the overall market for a product or service is growing.

The BCG Matrix categorizes a company’s products or services into four quadrants:

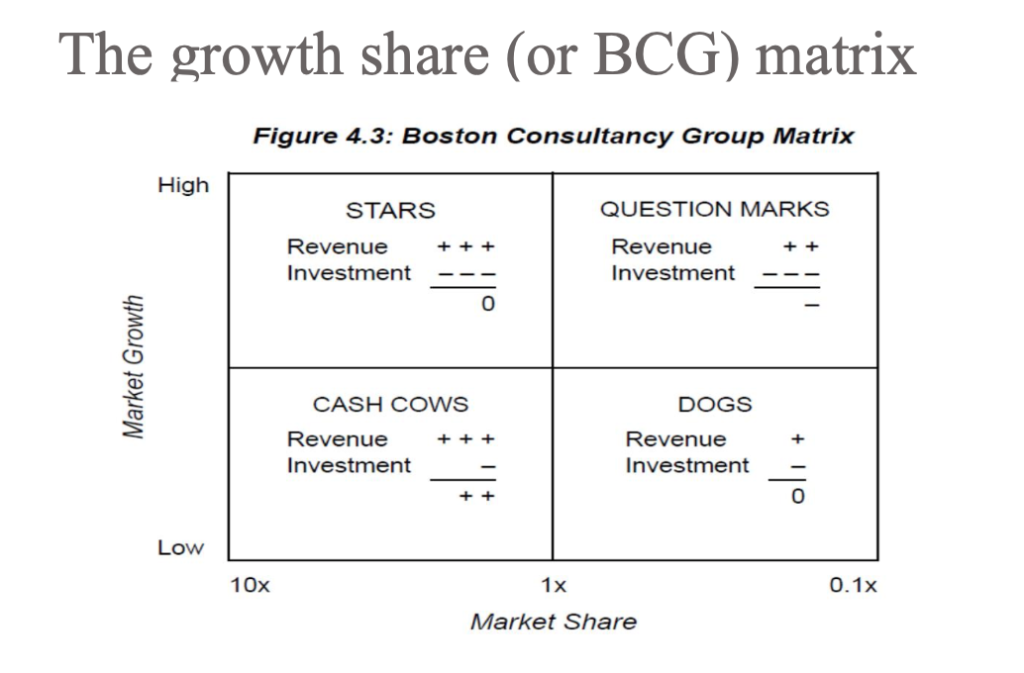

- Stars: products or services with a high market share in a high-growth market. Examples of financial metrics for stars might include high revenue growth rates, high-profit margins, and strong cash flows. Companies might invest heavily in stars to maintain their market share and capitalize on growth opportunities.

- Cash cows: products or services with a high market share in a low-growth market. Financial metrics for cash cows might include high revenue, strong profit margins, and consistent cash flows. Companies may allocate fewer resources to cash cows since they are already well-established in the market, and instead, use the cash generated to fund other parts of the business.

- Question marks: products or services with a low market share in a high-growth market. Financial metrics for question marks might include low revenue, negative or low-profit margins, and negative or inconsistent cash flows. Companies may need to invest in question marks to build market share and capitalize on growth opportunities, but also need to be mindful of the risks associated with these products.

- Dogs: products or services with a low market share in a low-growth market. Financial metrics for dogs might include low revenue, low-profit margins, and negative or inconsistent cash flows. Companies may need to restructure or divest dogs to free up resources and focus on more profitable products or services.

The objective of the BCG Matrix is to provide a visual representation of a company’s product portfolio and help managers make informed decisions about which products or services to focus on. For example, stars may require investment to maintain their high market share in a rapidly growing market, while cash cows may provide a stable source of revenue that can be used to fund other parts of the business. Question marks may require further analysis to determine whether they have the potential to become stars or should be divested, and dogs may be candidates for divestment or restructuring.

By using the BCG Matrix to analyze their product portfolio, companies can make more informed decisions about how to allocate resources, optimize their product mix, and ultimately improve their financial performance.

Example:

An example of a real-world company on the BCG matrix is Apple Inc. Apple’s product portfolio can be divided into four categories:

- Stars: iPhone and iPad

- Cash cows: Mac computers and iTunes

- Question marks: Apple Watch and Apple TV

- Dogs: iPod

The iPhone and iPad are considered stars because they are high-growth products with a large market share and potential for continued growth. Mac computers and iTunes are cash cows because they generate consistent cash flow but have limited potential for future growth. The Apple Watch and Apple TV are question marks because they are high-growth products but have a low market share and require significant investment to grow their market share. The iPod is considered a dog because it is a low-growth, low-market-share product that is unlikely to generate significant profits and may require divestment.

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

I have to express some appreciation to this writer for rescuing me from this particular problem. Because of researching throughout the online world and finding techniques that were not helpful, I assumed my life was well over. Existing minus the strategies to the issues you’ve sorted out as a result of this blog post is a critical case, and those which could have badly affected my career if I had not come across your blog. Your personal know-how and kindness in touching all the things was vital. I’m not sure what I would’ve done if I hadn’t come across such a subject like this. I can also at this time look ahead to my future. Thanks for your time very much for this reliable and result oriented guide. I will not hesitate to propose your web blog to any person who wants and needs care on this issue.